Credit Card Market Share Statistics and Facts 2025

Credit cards are crucial for financial transactions in 2025, offering convenience and flexibility to millions of users worldwide. In the U.S., the credit card market is valued at approximately $160.3 billion, with over 75% of households owning at least one general-use credit card.

Americans use credit cards for an estimated 62.6% of retail spending, highlighting their significant role in consumer behavior. With 600 million active credit card accounts, the market continues to evolve due to technological advancements and changing consumer preferences.

Read on for an in-depth look at the current trends and data in the credit card market.

Key Credit Card Statistics 2025

- The global credit card payments market size will cross 877.6 billion in 2025.

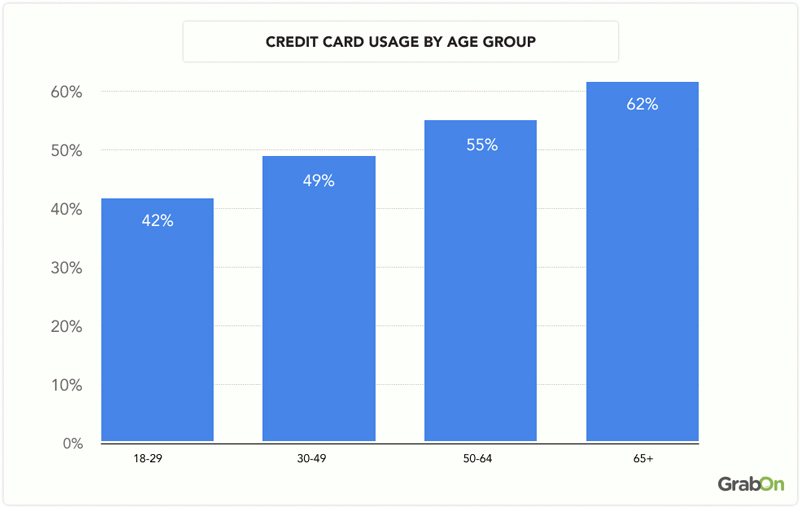

- The 65+ age group has the highest credit card usage at 62%.

- Visa leads the market share among credit cards with over $7 trillion in transactions.

- Approximately 214.9 million U.S. adults own credit cards.

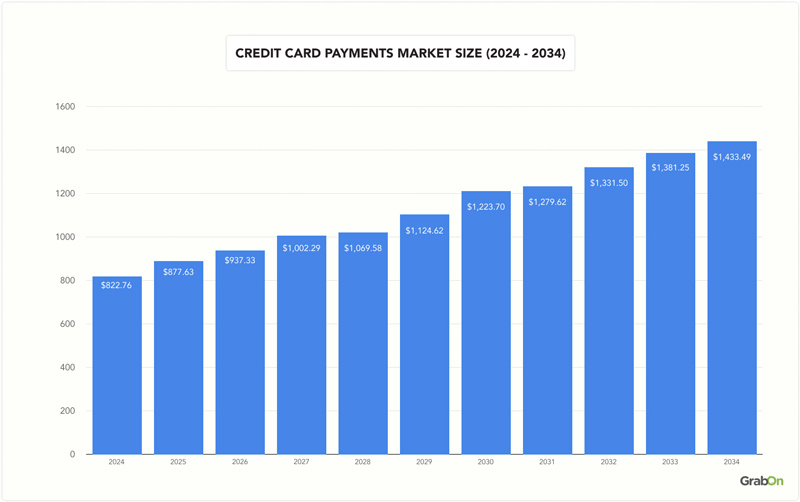

Credit Card Payments Market Size (2024 – 2034)

- The credit card payment market is projected to reach $877.63 billion in 2025, up from $822.76 billion in 2024.

While new payment methods such as mobile wallets, BNPL options, and digital currencies have gained popularity, credit cards are still widely used.

- The market is expected to grow from about $823 billion in 2024 to over $1.43 trillion by 2034, indicating a strong upward trend over the next 10 years.

- The industry is projected to surpass $1 trillion around 2030, reflecting increasing consumer adoption of credit card payments and related financial services.

| Year | Credit Card Payment Market Size (USD Billion) |

| 2024 | $822.76 |

| 2025 | $877.63 |

| 2026 | $937.33 |

| 2027 | $1,002.29 |

| 2028 | $1,069.58 |

| 2029 | $1,124.62 |

| 2030 | $1,223.70 |

| 2031 | $1,279.62 |

| 2032 | $1,331.50 |

| 2033 | $1,381.25 |

| 2034 | $1,433.49 |

(Source: Precedence Research)

Credit Card Usage by Age Group

- 18-29 years old: 42% of individuals in this age group use credit cards. The lower percentage can be attributed to the younger generation’s preference for online payment methods and digital wallets.

- 30-49 years old: 49% of consumers in this age range use credit cards, reflecting a balanced mix of traditional and digital payment preferences.

- 50-64 years old: Approximately 55% of people in this demographic use credit cards, indicating a higher reliance on credit for financial transactions.

- 65 years and older: Around 62% of individuals in this age group use credit cards, making them the highest users of credit cards among all age groups.

(Source: Statista)

Credit Card Market Shares

The credit card market is a dynamic and competitive industry featuring major players like Visa, Mastercard, American Express, and others. From global giants to regional leaders, understanding market share trends reveals the influence of key companies and regional variations in consumer preferences. This overview examines the distribution of market shares among leading credit card companies and explores how these shares vary across different regions, providing insights into the expanding credit card industry.

Credit Card Companies' Market Share

- Visa leads the market with the largest share, processing an impressive $6.22 trillion in transactions. Its extensive global network and widespread acceptance make it the preferred choice for many consumers and businesses.

- Mastercard holds the second-largest market share, with $2.59 trillion in transactions. Known for its security features and innovative payment solutions, Mastercard remains a strong competitor in the credit card industry.

- American Express processed $1.14 trillion in transactions. While it has a smaller market share than Visa and Mastercard, American Express is renowned for its premium services and rewards programs, attracting a loyal customer base.

- Discover had $218 billion in transactions. Discover is known for its customer-friendly policies and cashback rewards, making it a popular choice among some consumer segments.

Top Credit Card Transactions

| Card | Transactions |

| Visa | $6.22 trillion |

| Mastercard | $2.59 trillion |

| American Express | $1.14 trillion |

| Discover | $218 billion |

(Source: Capital One Shopping)

Credit Card Market Share by Region

The credit card market shows significant regional variation, reflecting diverse economic, cultural, and technological factors. North America leads with high ownership rates, with Visa and Mastercard dominating, while Europe displays mixed adoption, from Norway's strong usage to France’s lower penetration. Asia-Pacific sees rapid growth, driven by markets like India and South Korea, despite China's preference for mobile payments. Latin America is expanding, led by Brazil, whereas the Middle East and Africa face slower adoption due to a cash-centric culture, though digital payment trends are rising. Here's a detailed breakdown of credit cards' market share by region:

North America

- The North American credit card industry grew from $212 billion in 2021 to about $292 billion in 2025, a 72.7% increase. It’s expected to reach over $538 billion by 2033, growing at an average annual rate of 7.96%.

- Canada is expected to have the highest credit card ownership, reaching 84.55% by 2029, after 7 consecutive years of growth. Visa and Mastercard are major digital payment options in the U.S. and Canada.

- Approximately 214.9 million U.S. adults (about 82% of the adult population) have a credit card account in their name.

Europe

- Norway: Approximately 71% of adults own a credit card.

- United Kingdom: High credit card usage, with over 200 billion euros in transactions.

- France: Lower usage compared to the UK, with significantly fewer transactions.

- Germany: Over 7 million credit cards in circulation.

- Turkey: The number of credit cards is roughly 50% higher than in the UK.

Asia-Pacific

- China: The value of credit card spending in China is approximately 8.69 trillion Yuan. The market is growing, but mobile payments are more prevalent.

- India: As of 2024, approximately 100 million credit cards are in use. The number is projected to exceed 150 million due to rising consumer spending patterns.

- Japan: Credit cards are the most popular non-cash payment method, with about 2.8 cards per adult. The total transaction value of credit cards has risen, reaching around 73.4 trillion Yen in recent years.

- South Korea: More than 150 million credit cards have been issued as of 2025. The credit card payment market is projected to exceed $800 billion by the year’s end.

Latin America

- In Brazil, credit card usage has grown, with approximately 84.7 million individuals having credit card debts as of 2022. The market expanded by 30.9% between 2019 and 2022, increasing consumer spending and credit card adoption.

- In Mexico, credit card ownership is predominantly urban, with around 9.5% penetration. The country uses debit cards more, with roughly 5 times more of it in circulation than credit cards.

Middle East and Africa

- The Middle East credit card industry grew from $21.31 billion in 2021 to $27.92 billion in 2025, marking a 76.33% increase. By 2033, it's expected to reach $48.72 billion with a CAGR of 7.21%.

- In 2025, Saudi Arabia leads with 32.51% credit card market share, followed by the UAE (11.54%), Turkey (11.32%), Qatar (7.89%), Egypt (7.59%), and the rest of the region at 29.15%.

- Africa: Credit card penetration is relatively low compared to other regions. Mauritius has the highest credit card ownership at 20.06%, while Tanzania has the lowest at 0.31%.

The rural nature of many areas and a strong preference for cash transactions contribute to the low adoption rates.

(Source: Statista, Cognitive Market Research)

Credit Card Debt Statistics 2025

- Credit Card Balances: The total outstanding credit card balances reached a significant $1.21 trillion in December 2024. This marks an increase of $45 billion from the previous quarter, indicating a steady rise in consumer credit card usage.

- Quarterly Growth: The 1.5% rise from Q3 2024 highlights the ongoing trend of increasing credit card debt among U.S. consumers. This growth reflects higher spending and greater reliance on credit for everyday expenses.

- Aggregate Delinquency Rates: There has been a slight increase in aggregate delinquency rates, with 3.6% of outstanding debt now in some stage of delinquency. This suggests that while more people use credit cards, some struggle to keep up with payments.

- Serious Delinquency: The transition into serious delinquency (90+ days past due) has edged up for credit cards. This indicates a growing number of consumers facing significant challenges in managing their credit card debt.

(Source: Federal Reserve Bank of New York)

Shift from Credit Cards to Contactless Payments

- The shift from traditional credit card payments to contactless methods has been accelerated by the COVID-19 pandemic, which increased the demand for touch-free transactions. In the U.S., contactless payments grew from just 3% of all card transactions in 2017 to 25% in 2023.

This trend is mirrored globally, with over 50% of all transactions expected to be contactless by 2025. The adoption of mobile wallets, such as Apple Pay and Google Pay, has further driven this shift.

- Contactless payments have seen a significant rise globally, driven by convenience and hygiene benefits. In 2022, the contactless payment market was valued at $22.4 billion and is expected to reach $90.6 billion by 2032.

By 2027, global contactless payment transactions are projected to surpass $10 trillion, marking a 221% increase from 2022.

(Source: Scoop Market, Fit Small Business)

Frequently Asked Questions

What is the 2/3/4 rule for credit cards?

The 2/3/4 rule is a guideline used by Bank of America to limit the number of new credit cards you can open within specific time frames. Here's how it works:

- 2 cards in 2 months: You can be approved for up to 2 new Bank of America credit cards within 2 months.

- 3 cards in 12 months: You can be approved for up to 3 new Bank of America credit cards within 12 months.

- 4 cards in 24 months: You can be approved for up to 4 new Bank of America credit cards within 24 months.

This rule helps manage the risk associated with issuing multiple credit cards to a single individual in a short period. Plan your credit card applications accordingly to maximize your chances of approval.

Which country uses credit cards the most?

Canada has the highest credit card penetration rate globally, with 82.7% of consumers aged 15 and above owning a credit card. This high rate is driven by the country’s advanced digital payment infrastructure and widespread acceptance of credit cards for various transactions.

What are the 4 major credit card companies?

- Visa: The largest payment network, widely accepted by merchants globally.

- Mastercard: Another major network known for its extensive international acceptance.

- American Express (Amex): Offers premium services and rewards, with a strong presence in the U.S.

- Discover: It's known for cashback rewards and no-annual-fee cards.

What percentage of Gen Z has a credit card in the US?

Approximately 63% of Gen Zers in the U.S. have at least one credit card. This engagement is often to build their credit scores and manage their finances.