12 Amazon Logistics Statistics You Need to Know In 2024

Amazon’s logistics network is a cornerstone of its global operations, enabling it to deliver millions of packages daily. Amazon Logistics ships approximately 13.2 million packages daily, translating to over 547,945 packages per hour.

Amazon Logistics’ revenue grew by 19% year over year and it is increasingly going environmentally friendly by planning to use 100,000 electric vehicles by 2030.

In this blog, we’ll explore the most important Amazon logistics statistics for 2024, shedding light on the factors that drive Amazon’s success.

Amazon Logistics Statistics 2024 – Top Picks

- Amazon Logistics' revenue reached $28.6 billion in 2023.

- The DSP program by Amazon has over 275,000 drivers worldwide.

- Amazon Logistics has a revenue market share of 14% in the Logistics industry.

- By 2030, Amazon aims to have 100,000 electric vehicles for deliveries.

- Amazon operates over 175 fulfillment centers globally.

Amazon Global Reach Statistics

- As of 2024, Amazon has approximately 310 million active users worldwide.

This vast user base highlights Amazon’s significant global reach and influence in the e-commerce market. The platform attracts millions of customers daily, offering a wide range of products and services to meet diverse needs.

- Amazon ships to more than 100 countries worldwide.

This extensive reach allows customers from various regions to access a wide range of products and services, making Amazon a truly global e-commerce platform.

The top 10 countries which represent some of Amazon’s most significant markets are –

- The United States

- Canada

- The United Kingdom

- Germany

- India

- Japan

- Australia

- France

- Italy

- Spain

- Approximately 2.9 billion people visit Amazon.com every month, making it one of the most visited websites globally.On average, visitors spend about 6 minutes on the site per visit, viewing nearly 9 pages. The majority of Amazon’s traffic comes directly, indicating strong brand loyalty.

- Amazon’s net sales revenue worldwide reached nearly $575 billion in 2023, marking a significant growth of 12% compared to $514 billion in 2022.

(Source: Amazon, Similarweb, Influencer Marketing Hub)

Amazon Fulfillment Centers Statistics

- Amazon has more than 150 large-scale fulfillment centers.

These centers handle the bulk of Amazon’s order processing, including storage, picking, packing, and shipping of products. - In addition to the large-scale centers, Amazon has over 25 smaller sorting centers.

The sorting centers focus on sorting packages by destination to streamline the delivery process.

Amazon Logistics Revenue

Amazon Logistics demonstrated impressive growth in the U.S. parcel market, increasing its revenue by 19% to reach $28.6 billion, up from $24 billion in 2022. It also achieved the highest compound annual growth rate (CAGR) of 60% between 2016 and 2023.

Overall, the U.S. parcel market experienced a slight decline in revenue for the first time in 7 years, dropping by 0.3% from $198.4 billion in 2022 to $197.9 billion in 2023.

UPS generated the highest parcel revenue at $68.9 billion, despite a 6.4% decrease year-over-year. FedEx followed with $63.2 billion in revenue, marking a 3.1% decline, while USPS saw a modest increase of 0.8%, rising to $31.7 billion from $31.4 billion in the previous year.

USA Parcel Market Revenues

| Logistics Industry | Revenue |

| UPS | $68.8 billion |

| FedEx | $63.2 billion |

| USPS | $31.7 billion |

| Amazon Logistics | $28.6 billion |

(Source: Pitney Bowes)

Amazon Shipping Costs

Amazon has experienced a consistent rise in its annual shipping costs from 2011 to 2023. In the latest fiscal year, these costs reached $89.5 billion, marking an increase from $83.5 billion the previous year.

The increase can be attributed to several factors, including the expansion of its delivery network, the addition of more fulfillment centers, and enhancements in last-mile delivery services. These efforts are part of Amazon’s strategy to meet growing customer demand and maintain its competitive edge by offering faster and more reliable delivery options.

(Source: Statista)

Amazon Third-Party Sellers Statistics

In the second quarter of 2024, third-party sellers accounted for 61% of all paid units sold on Amazon.

Amazon’s third-party seller share has grown from 55% in Q1 2021 to 61% in Q2 2024. This reflects a 6% increase over three years, highlighting a consistent upward trend.

The growth has been gradual but steady, with the share increasing by 1-2% approximately every two to three quarters.

Amazon Third-Party Sellers Share

| Quarter | Share of paid units |

| Q2 ’24 | 61% |

| Q1 ’24 | 61% |

| Q4 ’23 | 61% |

| Q3 ’23 | 60% |

| Q2 ’23 | 60% |

| Q1 ’23 | 59% |

| Q4 ’22 | 59% |

| Q3 ’22 | 58% |

| Q2 ’22 | 57% |

| Q1 ’22 | 55% |

| Q4 ’21 | 56% |

| Q3 ’21 | 56% |

| Q2 ’21 | 56% |

| Q1 ’21 | 55% |

(Source: Statista)

Amazon Shipping Statistics

- In Q1 2024, Amazon set new records by delivering over 2 billion items to Prime members globally within the same or next day.

- In March 2024, Amazon reported that nearly 60% of all orders placed by Prime members in the 60 largest metropolitan areas in the United States were delivered within a day or the next.

- Amazon’s data also revealed that in major cities like London, Tokyo, and Toronto, 3 out of 4 items ordered by Prime members were delivered within the same day or the next.

(Source: CSA)

Amazon DSP Statistics

- Amazon’s Delivery Service Partner (DSP) program has helped nearly 3,000 entrepreneurs launch and scale their delivery businesses.This initiative allows small business owners to collaborate with Amazon, providing them with the tools and support needed to succeed in the logistics industry.

- The DSP program has significantly contributed to job creation, employing around 275,000 drivers worldwide.

- The network of DSPs plays a crucial role in Amazon’s logistics operations, delivering over 10 million customer packages every day.

- Through its network of DSPs, Amazon has generated over $26 billion in revenue for small businesses, creating a positive impact on communities worldwide.

- The DSP program supports Amazon’s global delivery operations and is active in over 14 countries, including France, Italy, Ireland, Brazil, the Netherlands, India, Belgium, and Austria.

- Amazon achieved its fastest global delivery speeds for Prime members, with over 7 billion items delivered on the same day or the next. This includes more than 4 billion deliveries in the U.S. and 2 billion in Europe.

- Between 2019 and 2023, Amazon improved its global lost time incident rate by 60% and its global recordable incident rate by 30%. From 2022 to 2023, the company saw a 16% improvement in the worldwide lost time incident rate and an 8% improvement in the worldwide recordable incident rate.

(Source: Amazon, Amazon Shareholders Statement)

Amazon Flex Statistics

- Amazon Flex has partnered with over 100,000 independent drivers throughout the United States. These drivers use their vehicles to deliver packages, providing flexibility in scheduling and the ability to work on their terms.

- Amazon Flex drivers earn between $18 to $25 per hour.This pay range reflects factors such as location, time of day, and delivery efficiency, offering competitive compensation for flexible work.

- About 75% of Amazon Flex drivers work part-time, often seeking additional income to complement their primary jobs or looking for seasonal earnings.

(Source: Expert Beacon, Ridesharing Driver)

Amazon’s Carbon Footprint Reduction

- Amazon is committed to achieving net-zero carbon emissions across its operations by 2040.

- In 2023, Amazon reached a milestone by sourcing 100% of its electricity from renewable energy sources, reflecting its dedication to sustainability.

- The company has already introduced over 10,000 electric delivery vehicles globally as part of its efforts to reduce emissions. Amazon aims to expand this fleet to 100,000 electric vehicles by 2030, further enhancing its environmental impact.

- Since 2015, Amazon has successfully reduced packaging material usage by more than 3 million metric tons in the U.S., Canada, and Europe, contributing to waste reduction and resource conservation.

- Amazon’s Climate Pledge Friendly program now features over 1.4 million products with sustainability certifications, helping customers make environmentally conscious choices.

(Source: Amazon)

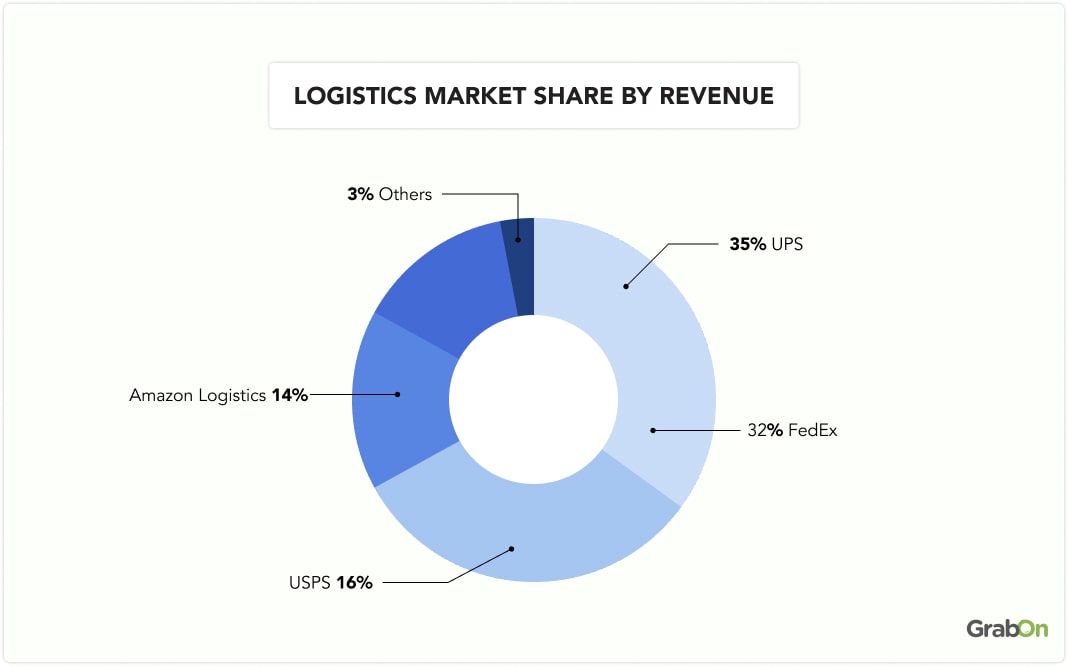

Logistics Market Share by Revenue

Amazon Logistics saw a notable increase in its revenue market share, rising by 2% to 14%. This growth reflects the company’s expanding presence in the logistics industry, positioning it as a stronger competitor among established players.

UPS remains the leader in parcel revenue market share, holding 35%, despite a 2% point decrease from 2022. FedEx follows with a 32% share, while USPS maintained its steady market share at 16%. Smaller carriers, grouped under the “Others” category, also experienced growth, with their combined market share increasing from 2.1% to 3%.

(Source: Pitney Bowes)

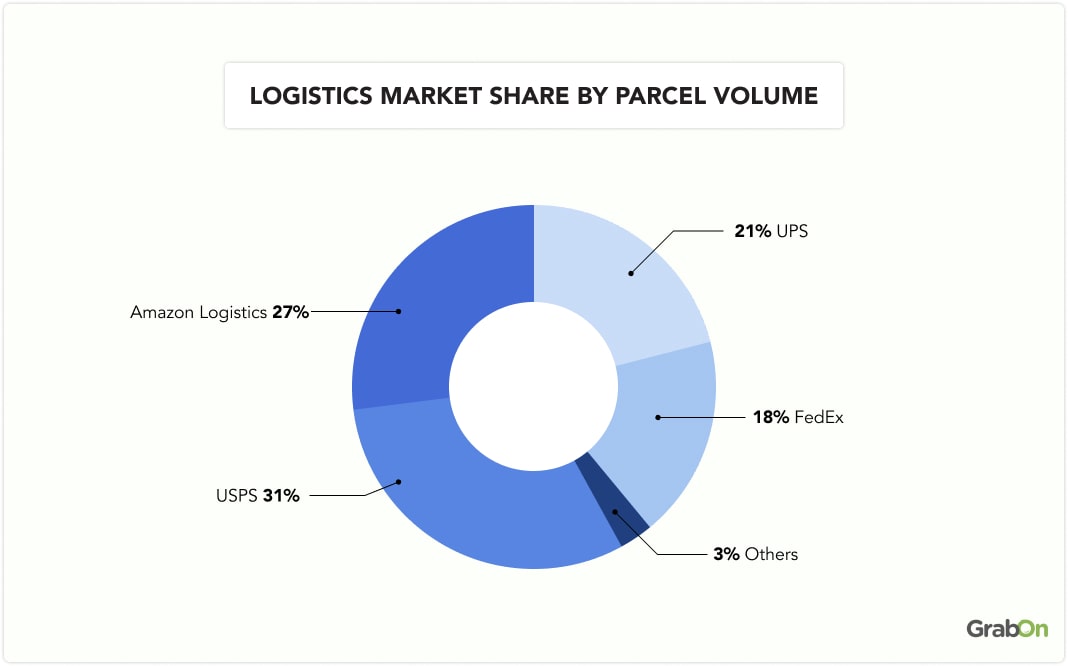

Logistics Market Share by Volume

With a 27% market share, Amazon has surpassed UPS, becoming the second-largest logistics provider for the first time.

USPS continues to lead the logistics market with the largest share, holding steady at 31%. UPS has now fallen to third place with a reduced market share of 21%, reflecting the increasing competition brought on by Amazon’s rapid expansion. The “others” category, consisting of smaller logistics providers, has also seen slight growth, increasing its combined market share from 2% to almost 3%.

(Source: Pitney Bowes)

FAQs on Amazon Logistics

Amazon Logistics plays a crucial role in ensuring the timely and efficient delivery of millions of packages worldwide. Below are some frequently asked questions about Amazon Logistics to help you learn more about their operations and efforts.

What is Amazon Logistics?

Amazon Logistics is Amazon’s parcel delivery system, handling deliveries for Amazon orders. It uses a network of delivery vehicles and contracted workers to ensure packages reach customers efficiently.

Does Amazon own Amazon Logistics?

Yes, Amazon owns Amazon Logistics. It operates as a part of Amazon’s broader logistics and delivery network, utilizing both Amazon’s fleet and third-party logistics partners.

What is the difference between Amazon delivery and Amazon logistics?

Amazon delivery refers to the actual process of delivering packages to customers, which can be done by various carriers including Amazon Logistics. Amazon Logistics, on the other hand, is the specific branch of Amazon responsible for managing and executing these deliveries.

What is Amazon Logistics Tracking?

Amazon Logistics Tracking allows customers to monitor their packages in real-time. By using the “Track Package” feature on Amazon’s website or app, customers can see the current location and status of their delivery, including estimated delivery times and any updates along the way.

How hard is it to become an Amazon DSP?

Becoming an Amazon Delivery Service Partner (DSP) involves a rigorous application process, including background checks and financial requirements. The process can take anywhere from three to six months, depending on the availability of opportunities in your area.

What is an Amazon Logistics center?

An Amazon Logistics center, often referred to as a fulfillment center, is a large warehouse where Amazon stores, picks, packs, and ships customer orders. These centers are equipped with advanced technology to ensure efficient order processing.