Venmo Statistics: Users, Transactions & Revenue (2024)

Venmo is a major P2P payment platform initially launched to settle bills among friends. It has gradually evolved into a platform facilitating easy transactions while functioning as a social hub.

Venmo now boasts a 90 million user base with widespread integration following the PayPal acquisition for $800 million. With an estimated revenue of over $3 billion in 2024, Venmo is set on an upward growth trajectory, establishing itself as a successful social payment platform.

Let's look at some statistical data and insights showcasing Venmo's user and revenue growth.

Venmo Statistics 2024 – Top Picks

- Venmo has 91.2 million active users.

- 608,000 websites use Venmo as a payment solution.

- Top 80% of US retailers use Venmo for transactions.

- Venmo processes over 516 million transactions every day.

- The 25 and 34 years age group constitutes the highest number of Venmo users.

- 33% of GenZ prefer to use Venmo for payments.

Venmo Overview

Venmo is a popular mobile payment service that allows users to easily send and receive money. It’s a social platform where transactions can include notes and fun emojis. Venmo also offers a debit card that can be used for purchases, and the app supports cryptocurrency transactions. Venmo is designed for quick, cash-free payments and is available primarily in the U.S.

| Founded | 2009 |

| Founders | Andrew Kortina, Iqram Magdon-Ismail |

| Headquarters | New York, US |

| Parent Company | PayPal (acquired in 2013) |

| Industry | Financial Technology |

| Product | Mobile payment app |

| Key Feature | Social payments with friends and businesses |

| Other Features | Splitting bills, Venmo Mastercard Debit Card |

How Many People Use Venmo

As of 2024, Venmo is used by 91.2 million people, and projections indicate that this number will increase by 6.5% by 2025 and reach 97.1 million users.

Venmo's user base has grown by 31.60% from 2021. This growth is largely accounted to Millenials who love taking advantage of Venmo's P2P transactions.

Here is a table showing Venmo's user base over the years:

| Year | Venmo Users | Growth |

| 2021 | 69.30 million | – |

| 2022 | 77.7 million | +10.8% |

| 2023 | 85.1 million | +9.52% |

| 2024 | 91.2 million | +7.16% |

| 2025* | 97.1 million | +6.46% |

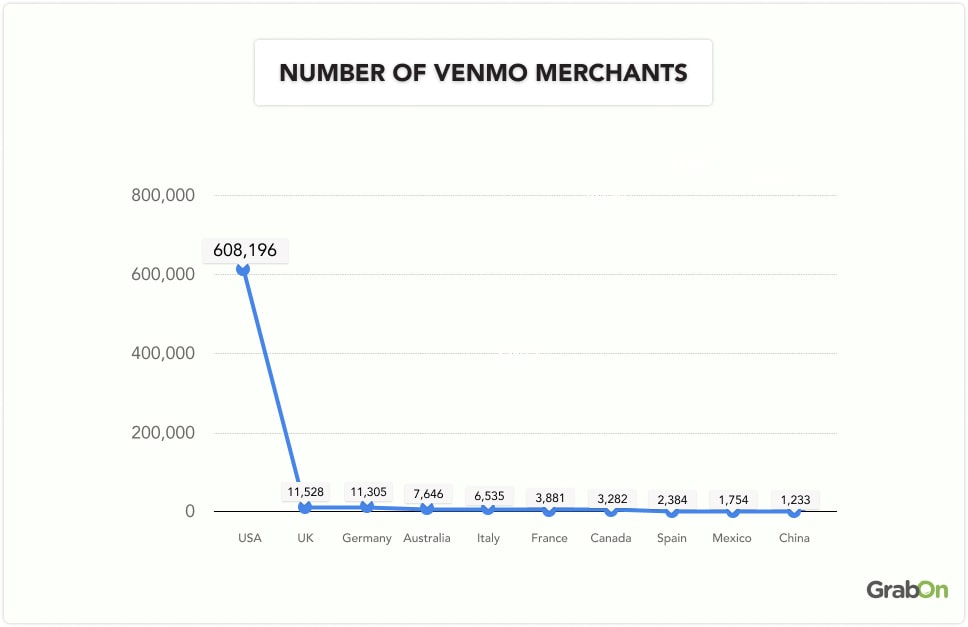

How Many Merchants Use Venmo

Over 2 million merchants use Venmo across 145 countries globally.

608,000 merchants in The United States use Venmo as a payment solution accounting for 30.4% of all merchants.

Here is a table showing countries with highest number of Venmo merchants:

| Country | Number of Merchant Websites |

| USA | 608,196 |

| UK | 11,528 |

| Germany | 11,305 |

| Australia | 7,646 |

| Italy | 6,535 |

| France | 3,881 |

| Canada | 3,282 |

| Spain | 2,384 |

| Mexico | 1,754 |

| China | 1,233 |

- Around 80% of top U.S. retailers have integrated Venmo into their payment systems.

- Approximately 65% of Venmo users utilize its QR Code feature, while the “Pay With Venmo” option has been adopted by over 9,000 merchants.

(Source: Statista, Money Transfers, Market Splash)

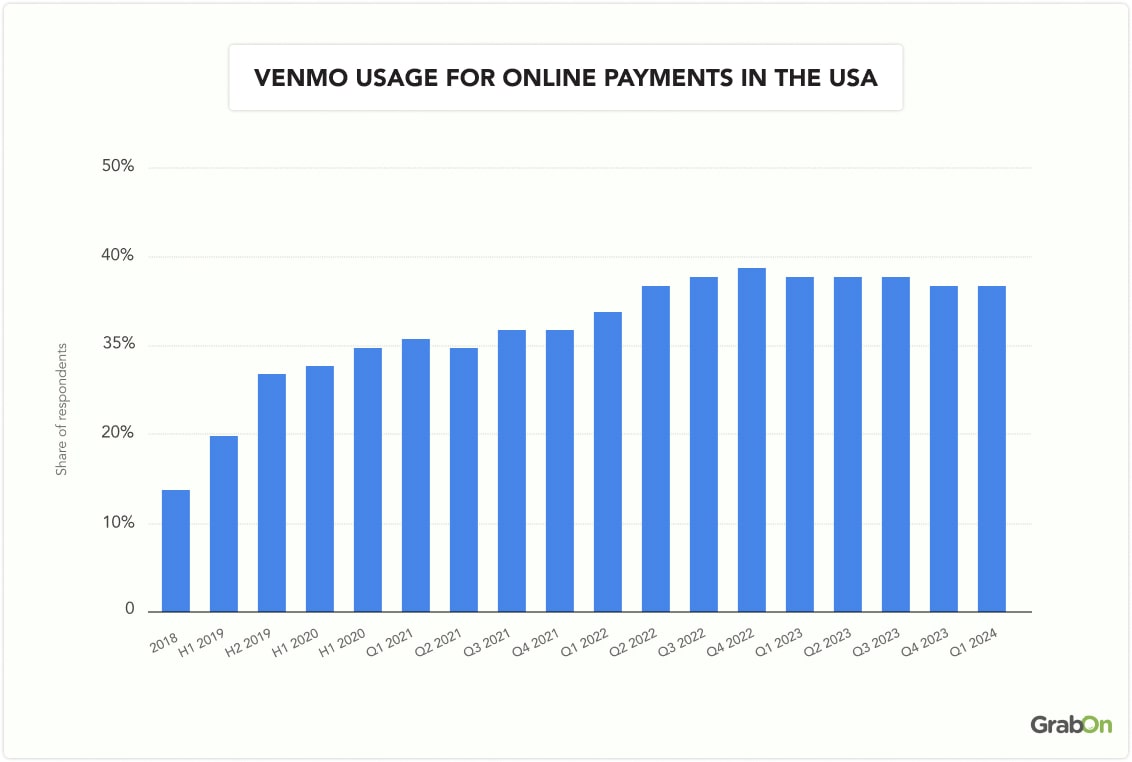

Venmo Usage Statistics

In a study by Paypal of more than 1000 consumers who made an online purchase over 2 weeks, it was found that shoppers are 19% more likely to complete a purchase with Venmo over traditional payment methods.

- Paypal's study of more than 300 thousand U.S. consumers and an analysis of more than 3.4 million transactions found that Venmo users shop over 2 times more frequently than the average shopper and are 19% more likely to make repeat purchases.

- 23% of Venmo customers are likely to consider using a retailer mentioned by a friend on their Venmo social feed.

- Over 30% of Venmo users use it for business-related transactions.

- 37% of online payments were done via Venmo in the first quarter of 2024 in the USA.

(Source: Paypal, Statista, MarketSplash)

(Source: Paypal, Statista, MarketSplash)

Venmo Engagement Statistics

- Venmo has an average of 12.31 million visits per month.

- During the 3-month period between March 2024 to May 2024, Venmo had 36.93 million website visits.

- On average, users spend 3 minutes on Venmo, which suggests that the platform’s design is optimized for quick and efficient financial transactions.

(Source: Similarweb)

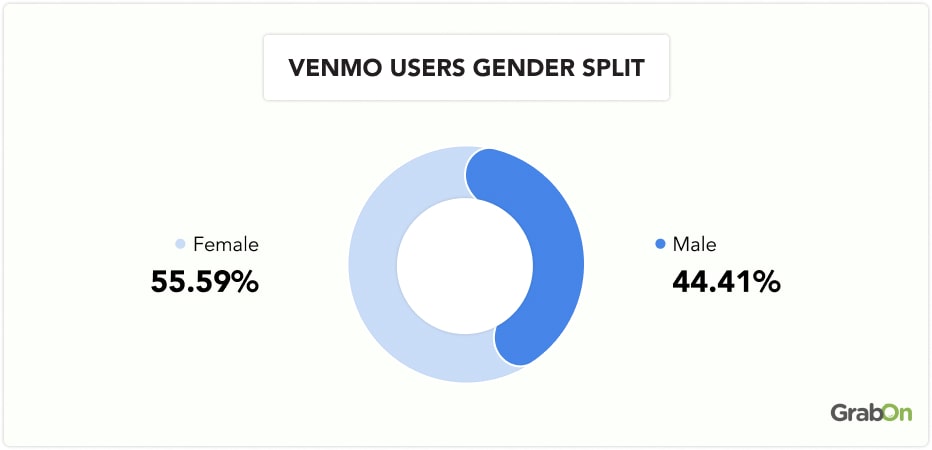

Venmo Demographics

- Venmo has 55.59% female users, while the rest, 44.41% are male users.

- The 25-34 age group comprises most of Venmo's user base.

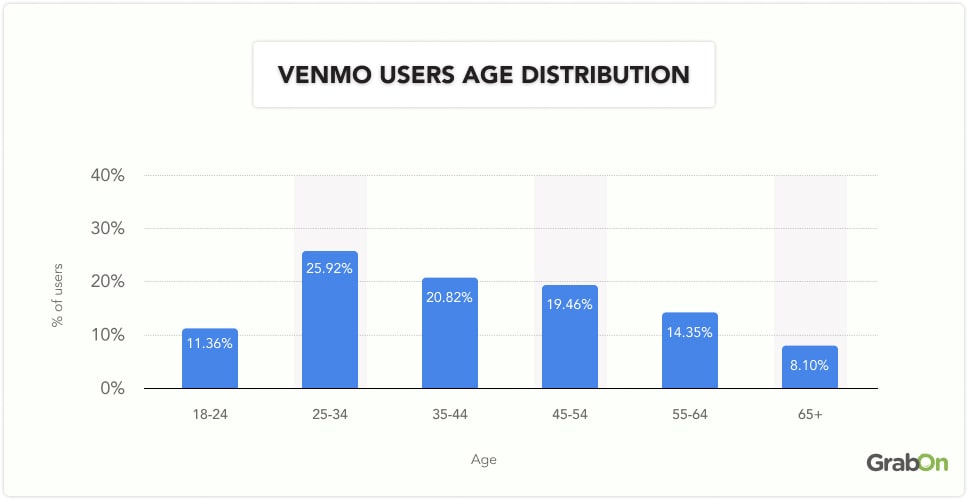

Venmo Users’ Age Distribution

| Age Group | User Distribution |

| 18-24 | 11.36% |

| 25-34 | 25.92% |

| 35-44 | 20.82% |

| 45-54 | 19.46% |

| 55-64 | 14.35% |

| 65+ | 8.10% |

- 16% of US adults use Venmo as their primary digital wallet.

- Mobile payment services have gradually seen higher use among GenZ, with 33% preferring to use Venmo over other platforms.

(Source: Similarweb, eMarketer, Survey Monkey)

Venmo Revenue Statistics

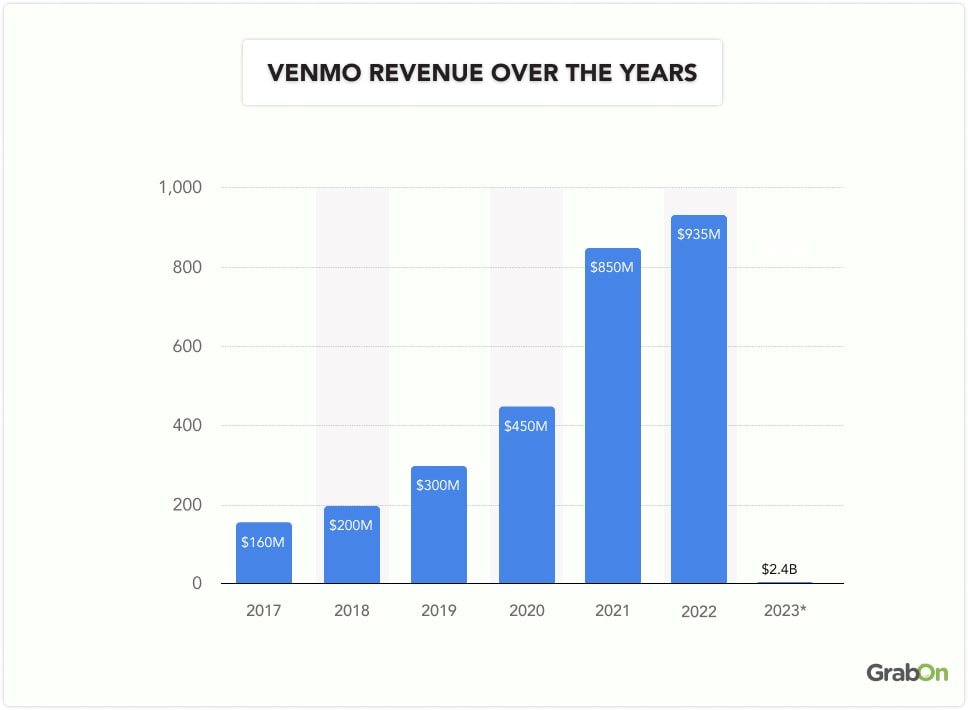

It is estimated that Venmo's revenue stood at $2.4 billion in revenue in 2023. This represents a significant increase from the $935 million revenue reported in 2022.

Venmo generates revenue through a 2.9% transaction fee for businesses. Venmo also charges a 1% fee for users who want to withdraw money instantly to their linked card.

This table shows Venmo's Annual Revenue Over The Years:

| Year | Revenue |

| 2017 | $160 million |

| 2018 | $200 million |

| 2019 | $300 million |

| 2020 | $450 million |

| 2021 | $850 million |

| 2022 | $935 million |

| 2023* | $2.4 billion |

(Source: Business of Apps,Yahoo)

Venmo Transaction Statistics

- The average transaction amount per user in Venmo is estimated to be between $65 and $75 per month.

How Many Venmo Transactions Per Day

Venmo processes over 516 million transactions daily on a global scale. Venmo account holders face a daily spending cap of $3,000 and a maximum of 30 transactions each day.

How Many Venmo Transactions Per Month

Venmo processes over 15 billion transactions per month, which accounts for 180 billion transactions per year.

Here is a breakdown of number of Venmo's transactions:

| Every Day | 516 million |

| Every Month | 15 billion |

| Every year | 180 billion |

Unverified Venmo accounts have a monthly transaction limit of $1,000, whereas those with verified accounts are permitted to send and receive up to $20,000 per month.

(Source: SignHouse, MoneyTransfers)

Venmo Social Statistics and Facts

- The majority of Venmo transactions include a message or emoji, with over 70% of transactions accompanied by some form of note or symbol.

- Around 65% of users opt to share their transactions publicly on the social feed, highlighting the platform’s unique social aspect.

- Despite the popularity of public sharing, there has been an increasing trend towards privacy, with 30% of users choosing to keep their transactions private, up from 20% in previous years.

(Sources: MoneyTransfers, Business of Apps)

Venmo Market Share

Venmo has 0.85% of the total market share in the payment management category making it the 9th most preferred payment platform.

Its top competitors, Stripe (38.6%) and PayPal (37.87%) have the largest share in this category.

| Company | Market Share |

| Paypal | 32% |

| Stripe | 20.54% |

| Stripe Connect | 19.62% |

| Adyen | 11.54% |

| Square Point of Sale | 3.38% |

| Braintree | 2.46% |

| Authorize.net | 1.51% |

| QuickBooks GoPayment | 1.29% |

| Venmo | 0.85% |

| WorldPay | 0.65% |

(Source: 6sense)

Venmo Vs. Cash App

Venmo, owned by PayPal, is renowned for its social feed, allowing users to share their transactions with friends, which adds a social element to the payment process. Whereas, Cash App is a service from Block, Inc. (formerly Square, Inc.) that extends beyond P2P payments to include features like investing in stocks and Bitcoin.

Here are some interesting comparisons between Venmo and Cash App:

Revenue

Venmo’s estimated revenue for 2023 is $2.4 billion. In comparison, Cash App generated a remarkable $14.3 billion in revenue in 2023, which is nearly 6 times the revenue of Venmo.

(Source: Finance Buzz)

Application Ratings

- On the App Store, Cash App has a rating of 4.8 out of 5 stars, whereas Venmo has a rating of 4.9 stars.

- On Google Play Store, Cash App's rating is 4.4 out of 5 stars while Venmo has a rating of 4.1 stars.

Application Downloads

- Venmo has over 50 million downloads on Google Play Store while Cash App has over 100 million downloads.

Rankings

- The Cash App application ranks 1st in Finance on the Apple store, while the Venmo app ranks 3rd.

Transfer Speed and Limits

- Venmo has a weekly spending limit of $6,999.99 for all transactions combined.

- Cash App has a sending limit of $7,500 per week and no limit to the amount you can receive.

Facts to Know About Venmo

Venmo has revolutionized the financial transaction scenario, allowing users to transfer money quickly and easily, split bills, and send money to friends and family. Venmo stands out for its unique features, combining social elements along with financial features. Here are some more interesting facts you should know about Venmo.

How much does Venmo charge?

Venmo charges no fees for sending money from a Venmo balance, bank account, or debit card. However, a 3% fee applies to payments made with a credit card. Instant transfers to a bank account incur a 1.75% fee (minimum $0.25, maximum $25), and businesses are charged 1.9% + $0.10 per transaction for goods and services.

Does Venmo need your bank account?

Venmo does not require a bank account for basic transactions, such as sending money from a Venmo balance. However, if you want to withdraw funds from Venmo or make payments that exceed your Venmo balance, you will need to link a U.S. bank account, credit card, or debit card to your Venmo account.

What is the daily limit for Venmo?

Venmo’s daily transaction limits depend on whether you’ve verified your identity. For unverified users, the weekly spending limit is $299.99, which includes person-to-person and merchant payments. Verified users can send up to $60,000 per week and spend up to $7,000 per week on purchases.

Can someone get your bank info from Venmo?

No, Venmo employs bank-grade encryption to safeguard your account information, ensuring that your bank details remain secure. on, ensuring that your bank details remain secure. Venmo uses services like Plaid to connect to your bank and retrieve account information without retaining your login data.